As active managers who seek to understand businesses, we take a keen interest in how companies are governed and the impact they have on society. Since our inception, we have held the view that a company that does not operate in a sustainable manner cannot sustain its profitability. This long-term mindset sits at the heart of our investment philosophy. An important aspect of governance is executive remuneration. It is therefore unsurprising that remuneration made up the largest category of our environmental, social and governance engagements in 2023. Nicole Hamman takes a look at some of our efforts and learnings using mining companies Sibanye-Stillwater and AngloGold Ashanti as examples, given that our efforts have yielded positive results.

The landscape of executive remuneration continues to evolve as executives are expected to deliver outcomes for a widening range of stakeholders. There are lots of differing ideas about how packages should be structured. We believe that a company’s remuneration policy should aim to attract, reward and retain competent executives, while aligning the interests of executives and shareholders. However, we realise that this is easier said than done. In this article, we explain why we focus on executive remuneration, how we evaluate schemes, and what our key learnings have been. To read about our other environmental, social and governance (ESG) efforts, and our approach to responsible investing, please see our latest Stewardship Report.

Executives whose incentives are aligned with shareholder interests are more likely to make decisions that unlock value for shareholders…

Why we focus on executive remuneration

Executives whose incentives are aligned with shareholder interests are more likely to make decisions that unlock value for shareholders and be deterred from making decisions that destroy value. This belief, encapsulated by the late Charlie Munger's assertion that “incentives drive behaviour”, is the driving force behind our continued focus on executive remuneration.

How we evaluate executive remuneration schemes

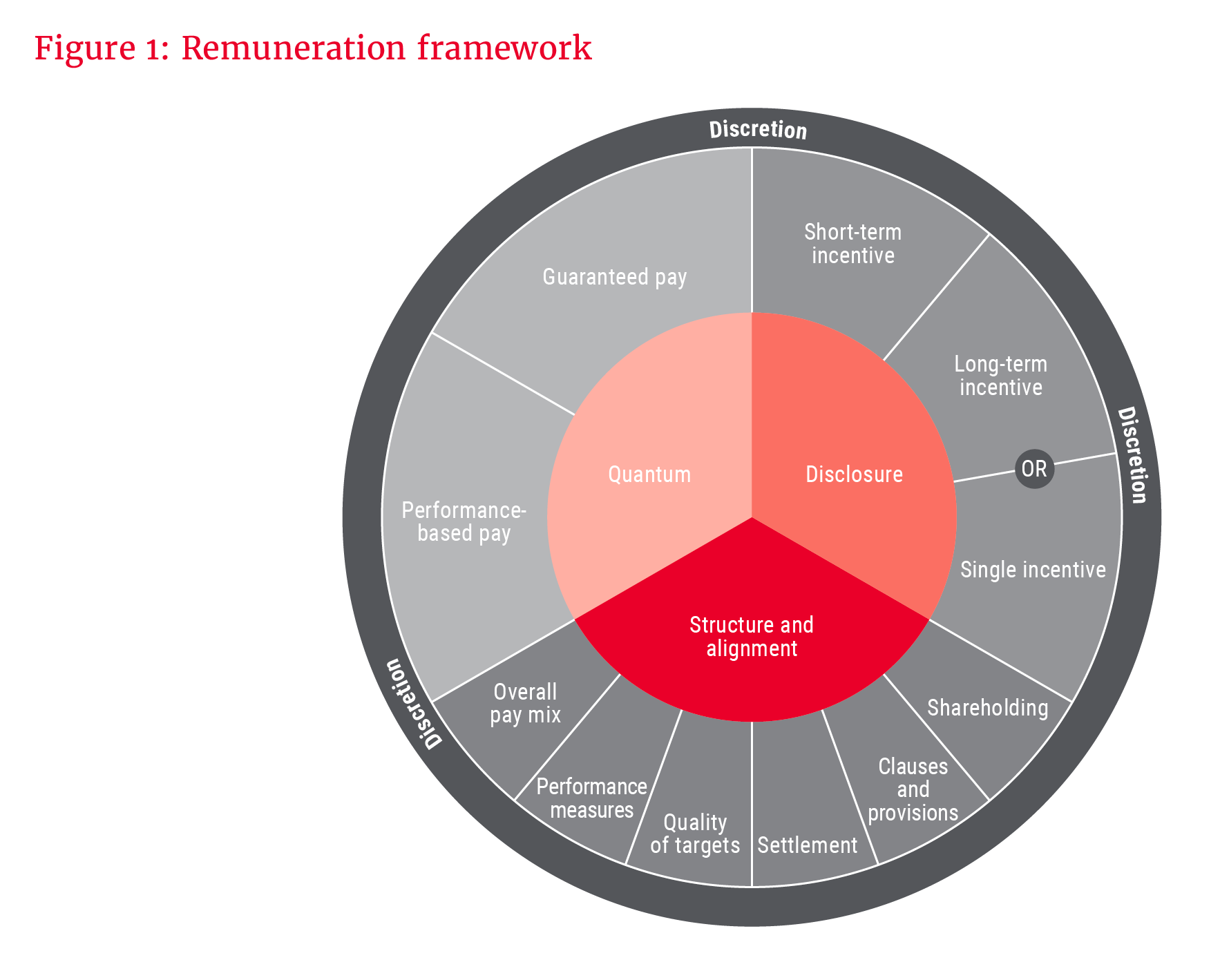

We evaluate each scheme on a case-by-case basis and take into account the special circumstances that may be affecting a company at the time. This involves the company analyst, governance analyst and the responsible portfolio manager to ensure we capture the necessary context, breadth and depth. The framework for the range of aspects we consider in our evaluation is represented in Figure 1.

Firstly, we establish whether there is sufficient disclosure to make an informed decision.

Secondly, we assess whether the structure achieves adequate alignment between shareholder and executives’ interests. To understand this, it is worth providing an example of misalignment.

Remuneration schemes outline executive pay opportunities based on three performance scenarios: threshold, target and stretch, with stretch representing stellar performance. An example of misalignment is when executive stretch pay reflects underwhelming company performance, leaving shareholders wanting. This mismatch can arise for various reasons, such as the performance metrics not being the key drivers of the business, or the financial metrics being overly adjusted, detaching them from reality. Our aim is to ensure that when executives earn stretch pay, it is well deserved, and shareholders also benefit.

Thirdly, we consider if the quantum of pay is reasonable. For example, there needs to be external parity, ensuring that stretch pay opportunities among direct peers are comparable.

Lastly, we consider the overarching use of discretion by remuneration committees which we believe must be pragmatic and only used when regarded as necessary to improve alignment. This is discussed in detail in our 2021 Stewardship Report.

Following our evaluation, there will often be engagement with remuneration committees. We aim for constructive engagements where we provide meaningful suggestions for improvement. We then decide whether to support or oppose the executive remuneration resolutions on behalf of our clients. These resolutions are tabled by issuers at their annual general meetings (AGMs). Supporting a resolution doesn't imply full satisfaction with the remuneration scheme, nor does opposing it mean a lack of confidence in the executive directors. When we oppose executive remuneration resolutions, we inform the company of our key concerns.

Our aim is to ensure that when executives earn stretch pay, it is well deserved, and shareholders also benefit.

Key learnings from past activities

Below, we unpack our key learnings from the activities we have undertaken in prioritising executive remuneration analysis and related shareholder action over the last few years.

1. Identify the root cause of concern

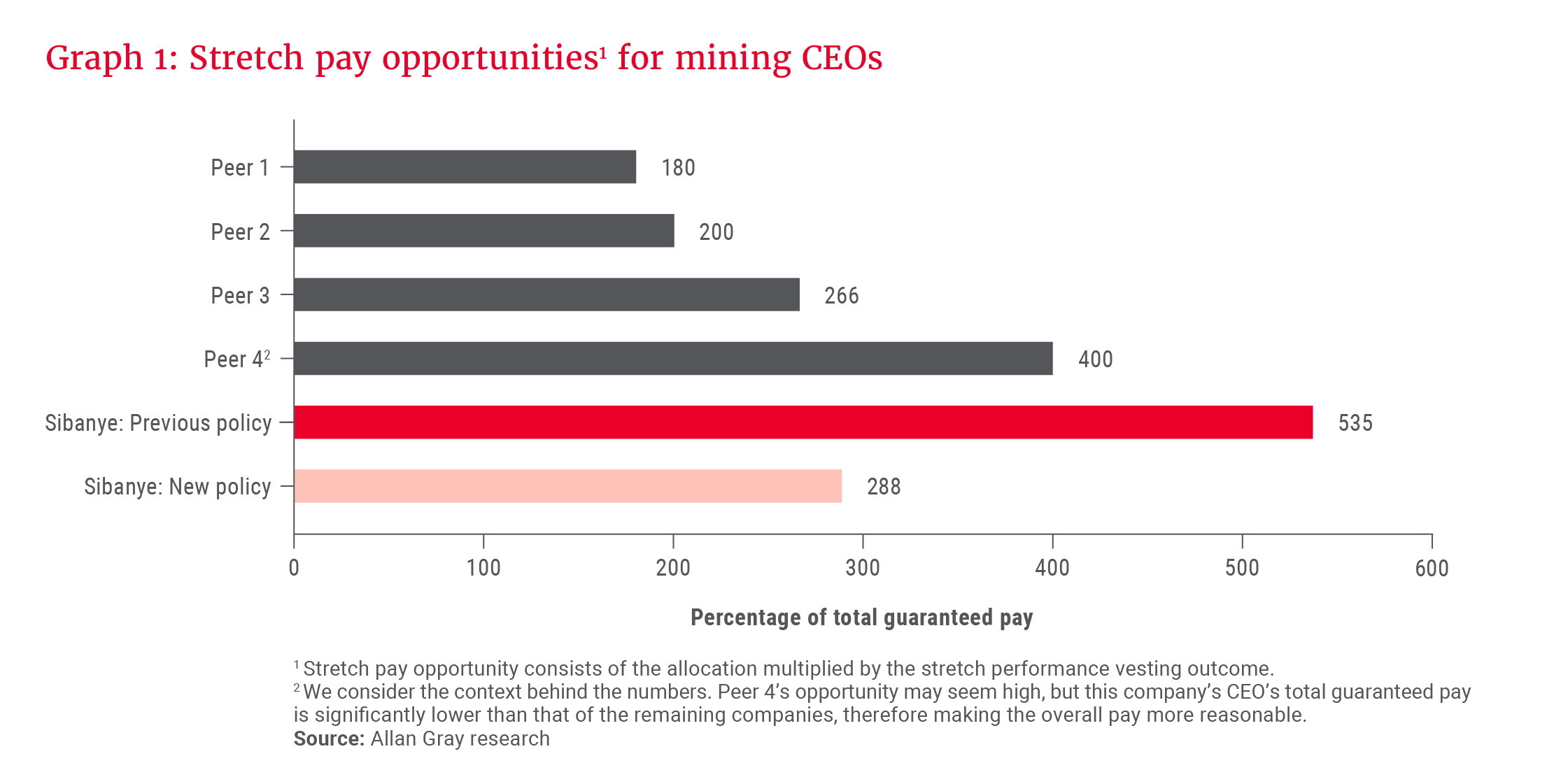

Often, the broad area of concern is apparent, but in order to suggest meaningful improvements, the root cause needs to be identified through deeper investigation. For example, in recent years, Sibanye-Stillwater (Sibanye) attracted media attention for high executive remuneration; its long term performance was strong, but pay outcomes were outsized relative to similar performing peers.

We benchmarked its long-term incentive structure, detailed in its policy, unpacking the different components. As shown in Graph 1, Sibanye’s CEO’s pay opportunity for stretch performance was significantly higher than that of its peers. While each company has a unique risk profile, and higher risk operations can account for some discrepancies, we found the extent of the differential too large.

We shared our observations and benchmarking results with the remuneration committee, and were pleased to see in Sibanye’s latest remuneration policy that the formula for allocating long-term incentives was revised, resulting in a significant reduction. Graph 1 includes Sibanye’s revised opportunity, which is more closely aligned with industry norms.

Sibanye also revised the allocation for several other roles below the CEO level, demonstrating how aligning executive remuneration with the market can have consequences for the broader pay culture. This was one of several improvements made, leading us to support Sibanye’s remuneration policy at the company’s 2024 AGM after years of being against it.

2. Stay the course

From 2021 to 2023, in contrarian fashion, we consistently opposed AngloGold Ashanti’s remuneration policy, despite it garnering strong shareholder support, as illustrated in Graph 2. We understand that shareholders have differing views, which remuneration committees need to balance, and that enacting positive changes takes time.

Our concerns stemmed from the incentive structure’s short-term focus. In a traditional set-up, executives’ performance-based pay consists of an annual bonus based on the previous year’s performance and a long-term incentive with a forward-looking three-year measurement period, i.e. one which they receive in three years’ time. However, AngloGold Ashanti employed a single incentive structure, where the link between the executives’ pay and forward-looking long-term performance conditions (and, in turn, our clients’ investment horizon) was less direct. Under this structure, all performance-based pay is typically allocated using a backward-looking measurement period of one year.

Although there are well-structured single incentive schemes, they are rare, and we find their structure less palatable for the mining industry. Given its cyclical nature, a short-term measurement period fails to capture through-the-cycle performance, potentially leading to binary pay outcomes. The industry also faces external pressures, such as volatile commodity prices and fluctuating exchange rates. Relative metrics, like total shareholder return (TSR), minimise the impact of external factors, but are rendered ineffective over a short period.

We stayed the course with AngloGold Ashanti, encouraging a return to separate instruments that can be appropriately calibrated to the short- and long-term drivers of the business. We were pleased to see their latest remuneration policy outline doing so, highlighting that the single incentive structure limited their ability to incentivise performance linked to their long-term strategic ambitions. Given the significant improvements, we supported their remuneration policy at their 2024 AGM.

3. Navigate the nuances

The effectiveness of a remuneration policy depends on how it is implemented, which includes several nuances. Below are two examples relating to target calibration.

- Miners typically include a cost metric as a key business driver, often setting absolute targets tailored to their unique cost positioning. AngloGold Ashanti, however, proposed a relative cost metric (compared to peers) as part of its new policy. We highlighted the complexity of this approach, as target calibration would need to account for AngloGold Ashanti’s current unfavourable position on the cost curve compared to peers, as well as the ramp-up of its low-cost operation, Obuasi, in Ghana.

- Another miner included an asset disposal metric. Although reasonable in principle, the target was set as an absolute amount, resulting in capital being raised from asset disposals without due consideration of the asset value, leading to value destruction for the group overall.

We will continue to actively engage on behalf of our clients, as we believe incentives do drive behaviour.

We also draw insights from our clients’ other holdings. Booking Holdings’ executive remuneration includes an absolute return gatekeeper, where the stretch pay opportunity cannot be achieved when company TSR is negative, and shareholders have effectively lost value. This feature, uncommon in South Africa, could translate well from one cyclical industry to another.

4. There will be trade-offs

Embedded within the executive remuneration of mining companies are ESG metrics, often including quantitative targets such as safety improvements and greenhouse gas emission reductions. While we support the inclusion of well-structured ESG metrics in remuneration when material, we also recognise that these metrics cannot fully capture the complex and dynamic interplay of environmental, social, governance and economic factors that miners must navigate. In fact, across industries, there are often inherent trade-offs both among these factors and within each of them. In our 2023 Stewardship Report, we examine how we weigh up ESG considerations at Sasol – a significant emitter with vital economic and social contributions.

5. Look out for soft cues

How companies engage with shareholders offers a rare glimpse into board dynamics and company culture. These soft cues weigh on our consideration of management and the board when making investment decisions. Do the remuneration committee members address questions, or do they defer to investor relations? Are they in agreement with our concerns, but face challenges in implementing improvements? It speaks volumes when positive strides are made, as they are often incorrectly perceived to come at a cost to management.

Cause and effect

Part of the opacity of executive remuneration lies in the inability to accurately derive cause and effect. Put differently, it cannot definitively be said a particular performance metric leads to a particular value-accretive or value-destructive decision, especially since improvements are often made incrementally.

While unclear, our 50-year history of assessing executive remuneration schemes and management performance leads us to believe there is a strong correlation. No remuneration policy is perfect; there are flaws in the ones we support, but we believe it is important to reward a positive trajectory – and that is unique to each company. With AngloGold Ashanti, our key concerns were structure and alignment, whereas with Sibanye, they were more granular. In both cases, we moved away from our long-standing view against the scheme when significant improvements were made.

We will continue to actively engage on behalf of our clients, as we believe incentives do drive behaviour.

In our latest Stewardship Report, we discuss the importance of preserving the frequency with which policy improvements (such as those explained in this article) can be made and maintaining the quality of directors on remuneration committees, which is crucial for continuity of positive outcomes.