As South Africans breathe a sigh of relief that loadshedding has tailed off, water risks have come to the fore. Multiple provinces are grappling with deteriorating water quality and increasingly frequent and lengthy disruptions to water supply. Raine Adams delves into the detail, focusing on water risks in Gauteng as the economic hub of South Africa — but many of the challenges resonate for other provinces as well.

The 2023 National Blue Drop Report, put together by the Department of Water and Sanitation (DWS), found that 46% of our water systems have an unacceptable microbiological water quality status, meaning that the water in these systems poses a serious acute health risk to the community. This is a drastic deterioration from just 5% of water systems in 2014 (the year of the previous Blue Drop Report). The provinces that fare the worst are Mpumalanga, the Northern Cape, the Eastern Cape and the Free State. The 2023 Green Drop Report, which evaluates wastewater treatment works, painted an equally concerning picture: 66% of our wastewater treatment works pose a high (34%) or critical risk (32%) of discharging partially treated or untreated water into rivers and the environment.

For many South Africans, these deteriorating statistics have been felt for some time. The Vaal River, for example, has seen a huge build-up of damaging invasive water lettuce due to years of raw sewage spillage because of dysfunctional wastewater treatment works. A multipronged approach is now underway to tackle the crisis. Multiple communities across the country, from Lichtenburg and Rustenburg in North West to Kimberley in the Northern Cape and Verulam in KwaZulu-Natal, have suffered the consequences of inadequate potable water supply, with business closures often an inevitable consequence.

Rand Water in focus

In December 2023, Rand Water issued an urgent notice to Gauteng’s three major metros – the cities of Johannesburg, Tshwane and Ekurhuleni – regarding water demand outstripping potable supply:

“Rand Water hereby cautions that, should this high consumption continue unabated, the water systems will eventually collapse.” – Media statement, 10 December 2023

Why was this warning of such importance for South Africa?

In 2023, Rand Water celebrated its 120th anniversary. It is the largest bulk water supplier in Africa, supplying potable water (i.e. water that meets drinking quality standards) to municipalities across Gauteng, as well as parts of Mpumalanga, the Free State and North West. Specifically, it supplies 17 municipalities, 27 mines and 952 industries and direct consumers. Roughly 80% of the water pumped by Rand Water goes towards sustaining the three major metros, and it is ultimately responsible for the water supply of over 15 million people.

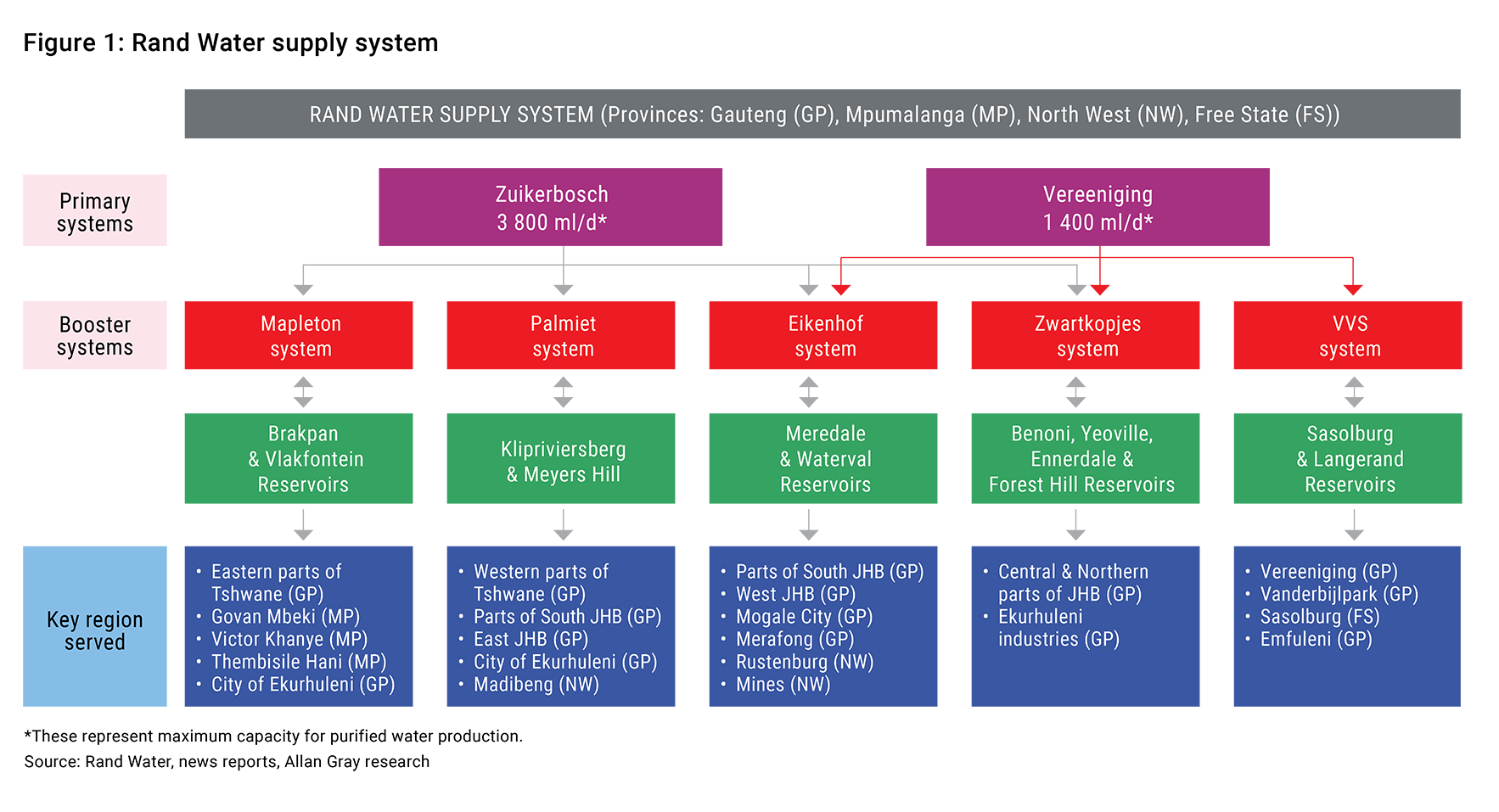

Rand Water abstracts raw water from the Vaal Dam, within the Integrated Vaal River System (IVRS). This water passes through two large treatment and pump stations, Zuikerbosch and Vereeniging, after which four main booster pump stations (Zwartkopjes and three satellite stations, Mapleton, Palmiet and Eikenhof) move the now-potable water to various regions – as shown in Figure 1. The distribution network consists of pipelines and strategically located storage reservoirs, from which potable water is pumped into municipalities’ reservoirs, where it is then mostly gravity-fed to households.

What has gone wrong?

Gauteng’s ongoing water disruptions reflect a combination of problems:

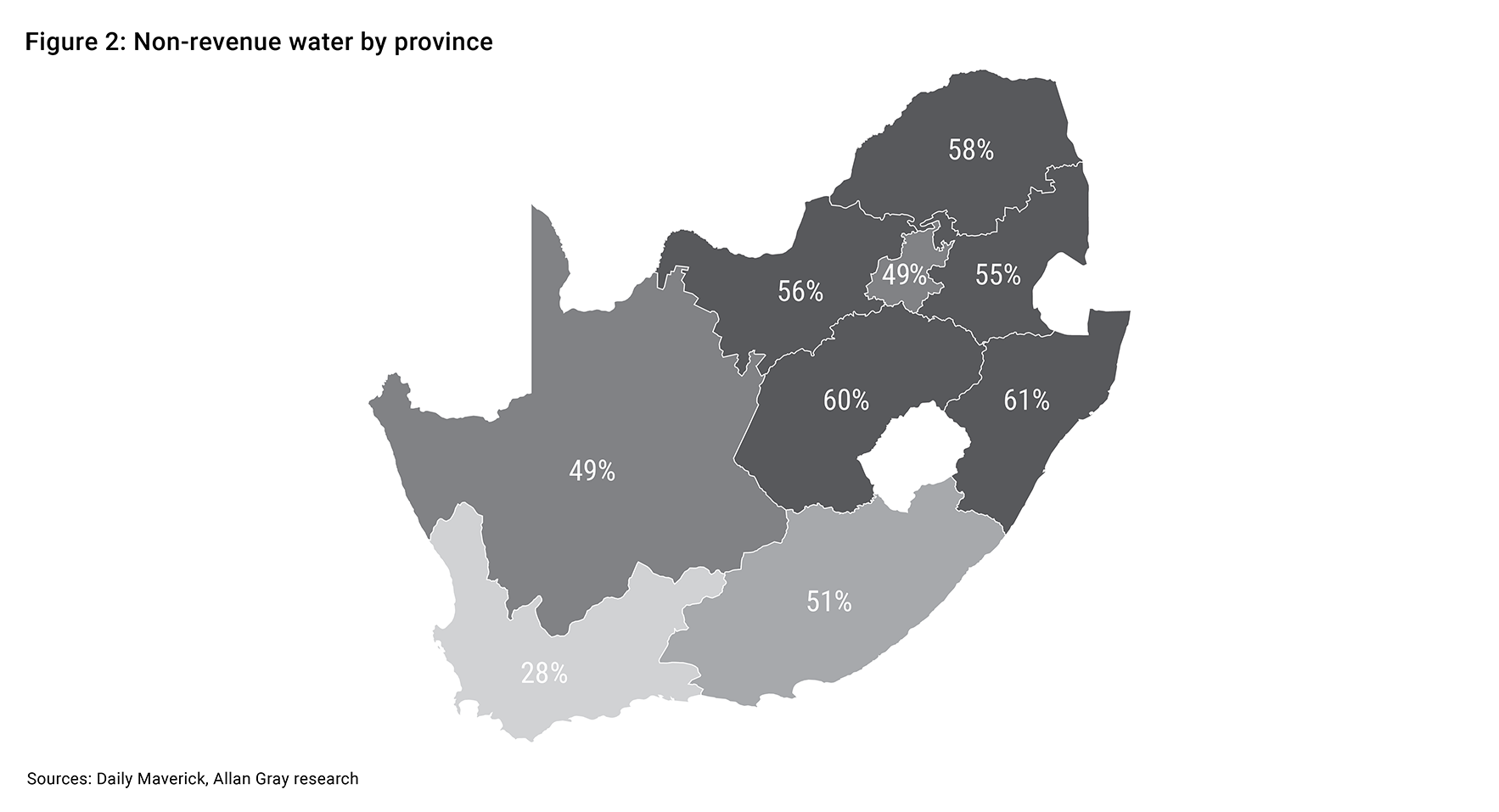

A leaking supply system exacerbates high demand

Rand Water is supplying into an ever-leaking municipal system. Figure 2 shows the percentage of non-revenue water (NRW) in each province. NRW mostly comprises real water losses i.e. physical leaks, but also commercial losses due to metering inaccuracies, water theft and data errors, as well as unbilled but authorised consumption (water used to produce potable water, i.e. process water and on-site consumption). Only the Western Cape’s average NRW falls below the global average of 30%. In Gauteng’s case, half of the water supplied is lost to physical water leaks or is unbilled, although performance differs significantly by municipality. At the Rand Water level, infrastructure has been well maintained and NRW is approximately 5%. While Rand Water notes that this still requires improvement, the majority of NRW is occurring in municipal networks once Rand Water “hands over” supply. This is due to municipalities neglecting infrastructure maintenance, in some cases for decades.

Nationally, our deteriorating NRW of 47% versus 37% in 2013 is unsustainable. To add insult to injury, in 2023, a year in which South Africans experienced 335 days of loadshedding, we were using our underperforming electricity to purify and pump water, roughly 40% of which was then wasted through leaks. Managing NRW down costs less than augmenting supply and needs to be a priority among our water service institutions.

High demand versus supply

On average across Gauteng, each person uses 316 litres of water per day, partly due to the above-mentioned high NRW. This is a very high (poor) water per capita use when compared to the global average of 180 litres per day. Across South Africa, our average water consumption is still excessive at 256 litres per day, especially considering that South Africa is in the top 30 driest countries globally.

Gauteng’s population growth and the consequent growth in water demand have exceeded the growth in water supply, with Rand Water recognising the availability of raw water as one of its critical risks. This is partly due to the delay in constructing Phase 2 of the Lesotho Highlands Water Project, intended to transfer an additional 490 million cubic metres of water from Lesotho to the IVRS per annum. Phase 1, completed in 2003, currently transfers 780 million cubic metres annually. Phase 2 of the project is nine years behind schedule and is now expected to reach completion by 2028. It is alleged that political interference played a significant role in the delays. Rand Water is currently able to supply 5 200 million litres of potable water daily and is already exceeding its abstraction limit from the IVRS. It will only be able to increase its abstraction when Phase 2 comes online.

The existing tunnel system supplying water from Lesotho to the IVRS shut down in October 2024 and is undergoing maintenance until March 2025. While this has led to concerns about Gauteng’s water supply over this period, government expects minimal supply disruption as IVRS dams, such as Sterkfontein, are relatively full and can supplement supply if the Vaal Dam’s level declines to 18% and a top-up is needed.

As noted by the director general of the DWS, Dr. Sean Phillips, the demand-supply relationship for potable water in Gauteng is now so tight that the system is more vulnerable to shocks, such as loadshedding in 2023, electromechanical breakdowns or cable theft and infrastructure vandalism. Even after Lesotho Highlands Phase 2 comes online, Gauteng will have to address high per capita water consumption, as there is a limit to bringing further capacity online affordably. The same goes for many other municipalities, particularly in a potentially more drought-prone future.

Power failures

Power trips or failures at substations (which are the responsibility of Eskom or the metro, such as City Power in the City of Johannesburg) frequently affect the supply to Rand Water’s pump and booster pump stations. Historically the reasons have varied, including lightning strikes, but the trips were exacerbated by heavy loadshedding in 2023. According to Rand Water, these pump stations cannot use backup generators as they require such substantial baseload electricity supply that it would require the installation of a plant. In other words, there is no Plan B when the power supply fails. This water system is complicated: Even with a relatively short outage, it can now take 10-14 days for outlying and high-lying regions to receive water again.

Considerations for the future

Rising municipal debt and infrastructure backlogs

Rand Water operates without assistance from the fiscus, meaning its liquidity and longer-term financial stability depend on revenue collection from its customers, primarily municipalities. Rand Water is owed billions of rands, with the large Gauteng metros – Rand Water’s biggest revenue stream – increasingly failing to pay their bills. Rand Water’s debtor days – i.e. number of days on average for accounts to be settled – nearly doubled from 56 in 2019 to 109 in FY2023 and remained excessive at 110 in FY2024.

For our largest bulk water supplier to execute on its commitments, its major customers need to foster a culture of payment. In turn, these customers need to implement proper billing systems and receive payments from their communities. Communities are happier to pay when receiving a reliable service and when financially able to do so, which ironically is hindered in the event of job losses that are exacerbated by service delivery failures.

Settlements encroaching over pipelines, servitudes and properties

Rand Water’s distribution network includes more than 3 500km of large diameter pipeline. Increasingly, informal settlements are encroaching on its land and pipeline servitudes. This brings various challenges, including the reduced ability to undertake critical maintenance on underground pipelines. Rand Water is implementing interventions, but this remains a concern in Gauteng, as well as other provinces such as KwaZulu-Natal.

Water quality

Gauteng, Limpopo and the Western Cape have the lowest percentage of water supply systems with “unacceptable” microbiological compliance, at 21-22% of total. However, the national average of 46% should be of great concern to South Africans. In addition, 44% and 24% of our water supply systems nationally were found to have unacceptable acute and chronic health chemical compliance, respectively.

Criminality and vandalism

South Africa is suffering years of unchecked corruption and criminality, and the water sector is no exception. Water tanker “mafias” are accused of sabotaging critical infrastructure to boost their businesses, while in some cases construction mafias interfere with water capital and maintenance projects. Restoring law and order needs to be an absolute priority across sectors.

Progress made

If municipal shortcomings are not tackled with greater urgency, South Africa faces a water crisis. But there are signs of progress. In 2021, Senzo Mchunu was appointed as Minister of Water and Sanitation. In the department’s subsequently developed Water Services Improvement Programme (2022) document, he wrote: “Over the last 25 years we, as government, have provided and spent hundreds of billions of Rands in grants, but with disappointing results. In the last year alone we, as national government, provided close to 40 billion Rand to municipalities to support water and sanitation services. Yet, what I am seeing is a decline in services, not an improvement. It is as if we bought a car and forgot to also purchase the maintenance plan. After years of not being maintained, these services are now breaking down. It will be a long and expensive process to fix, but we need to start now.”

While Mr Mchunu subsequently moved to Minister of Police in 2024, one of his key successes in the DWS was the reintroduction of the Blue, Green and No Drop Reports, which had been discontinued after 2014. Originally introduced in 2008, their intention was to recognise the water service institutions that were achieving excellence and identify and intervene where municipalities were struggling. This renewed transparency should contribute to enhanced accountability and corrective action.

Currently, the Blue Drop audit does not verify statistics around water supply disruptions but notes that the department must include the monitoring and quantification of “water shedding” and “dry taps” going forward. This will also be important to address the frequency and severity of these incidents.

In 2023, the DWS, in collaboration with the Development Bank of Southern Africa (DBSA) and the South African Local Government Association (SALGA), established South Africa’s first Water Partnership Office (WPO). This is a ringfenced project implementation office at the DBSA, which aims to accelerate water and sanitation infrastructure delivery by supporting municipalities to establish partnerships with – and mobilise finance from – the private sector. For example, the WPO is currently supporting an NRW programme, in which five metros (the eThekwini, Mangaung, Buffalo City, Nelson Mandela Bay and Tshwane municipalities) will unlock private sector finance for the replacement of leaking municipal water distribution pipes. While some municipalities are still performing well, in many cases there has been a loss of trust among potential funders owing to governance and operational failures. Ring-fenced product innovation and safeguarding mechanisms will therefore be important.

National Treasury has also expressed concern over the number of troubled municipal water businesses in South Africa and entered into engagements with the DWS and various stakeholders. Its Cities Support Programme has been supporting several metropolitan municipalities to turn around their water businesses.

The private sector continues to innovate and adapt to our country’s challenges. Astral Foods, one of the South African companies most impacted by historical loadshedding and water disruptions, has opted to build a R100 million water pipeline directly from the Vaal River to its Standerton plant. This is after years of municipal service delivery failures and winning a lengthy court case that allowed it to bypass the municipality’s water provision. Numerous companies are sinking boreholes, increasing their water storage capacity, and investigating ways to use wastewater more efficiently. The latter is especially important. Currently, only 14% of South Africa’s wastewater is reused. Finding ways to treat this water to an acceptable (but below-drinking water quality) standard means that it could be used by some industries, increasing the availability of our potable water delivery for human consumption.

DRD Gold serves as an example of a company that has done much to improve its water profile. Its reduction in potable water usage from 22% to 3% over the past decade demonstrates meaningful progress in resource efficiency. Perhaps more importantly, its business model – centred on tailings remining and responsible redepositing – delivers a notable environmental benefit by addressing point sources of groundwater contamination. This approach helps to reduce groundwater pollution and prevents further environmental damage, contributing to the improved availability of potable water and better long-term environmental outcomes.

Many companies are also stepping in to assist with municipal service delivery. Harmony Gold notes that many of the municipalities in its mining jurisdictions are unable to maintain and operate their wastewater treatment plants, resulting in raw sewage discharge into local streams and rivers. For example, untreated wastewater from Matlosana and Merafong ultimately feeds into the Vaal River – one of South Africa’s major water sources, as discussed earlier. Through its Social and Labour Plan, Harmony has funded the services of a wastewater management specialist company to assist these municipalities in refurbishing, operating and maintaining their wastewater treatment plants, and to rebuild the municipalities’ skills to ensure the facility’s sustainability.

Actions taken by Allan Gray

Despite South African companies’ efforts to bolster their resilience to water disruptions and reduce their municipal water dependence (when warranted), continuous water access and quality remains a key risk for many.

Since 2023, we have undertaken detailed research into South African water risks. Our focus has been on exposures within our clients’ top holdings, as well as holdings where our clients own a material percentage of the company. Company-specific engagements have spanned sectors, including retail, food manufacturing, hospitals, and mining. While a deterioration in South Africa’s municipal water services has been widely acknowledged, companies have also emphasised that this is not a new risk. As highlighted above, many have already completed projects or have initiatives underway to cushion the impact of disruptions. We believe the risks are being well managed. That said, water is a scarce resource, and large users in particular should keep striving to increase efficiencies. We will continue to engage with companies on their water management strategies and resilience.

Our research considers not only the “inward impact” of the availability of water on companies, but also the “outward impact” of company operations on the environment. For example, in 2024, we undertook a detailed review of water risk at Mondi, comparing pollution metrics and environmental incidents with those of US and European peers in the pulp and paper industry. Such supplementary ESG research enables us to pinpoint areas of potentially lagging environmental performance, identify areas of engagement and develop a clearer understanding of operational sustainability.