Investing offshore is an important way to diversify your portfolio, spread your risk and get access to companies and industries not available locally. Julie Campbell explores the options available to access offshore investments through Allan Gray, with a focus on the newly launched Allan Gray Offshore Endowment.

Many of you will have some offshore exposure through your investments in our core range of local unit trusts, namely our Equity, Balanced and Stable funds, which can invest up to 45% offshore, according to the foreign exchange limits prescribed by the South African Reserve Bank (SARB). There are various ways to achieve additional offshore exposure, as discussed next.

Invest and withdraw in rands

You can gain additional offshore exposure by using rands to invest in rand-denominated offshore unit trusts, such as the Allan Gray-Orbis Global Equity Feeder Fund, Global Balanced Feeder Fund and Global Optimal Fund of Funds, or other rand-denominated offshore unit trusts available via our local investment platform. Although your investment is priced in rands, your investment performance will be determined by the performance of the underlying offshore assets and the daily currency movements. You don’t need to buy foreign currency or get tax clearance from the South African Revenue Service (SARS).

When you invest in a rand-denominated offshore unit trust, you are subject to our standard local investment minimums, and use your investment manager’s offshore allowance instead of your own offshore allowance (see “How much can you invest offshore using your own offshore allowance?” below). However, since investment managers’ capacity to invest offshore is limited by the SARB, these unit trusts may close from time to time, as is the case with the Allan Gray-Orbis Global funds, which are currently closed to new discretionary investments, while investment through our life products is limited.

Although the Allan Gray Offshore Endowment is issued in US dollars, reporting is available in your preferred currency.

Invest in and receive foreign currency

If you are keen to invest in foreign currency using your own offshore allowance, there are a few routes you can take, one of which is to invest directly with fund managers of your choice. However, many investors find this route overwhelming due to the volume of available global unit trusts and the complexity of investing in multiple jurisdictions, including strict international anti-money laundering requirements, which have been exacerbated by South Africa’s greylisting. In addition, investment minimums tend to be high.

Allan Gray offers two options that simplify these complexities and may be suitable for you when using your own offshore allowance:

1. Invest via the Allan Gray Offshore Investment Platform

Investing via an offshore investment platform can help when it comes to narrowing down your options, dealing with the administration associated with offshore investing, and accessing minimums that can be lower than if you go to individual managers directly. The Allan Gray Offshore Investment Platform offers a small range of foreign currency funds, including those managed by our offshore investment partner, Orbis. We can help you convert your rands to foreign currency if you choose this route.

For more information about the characteristics and benefits of the Allan Gray Offshore Investment Platform, please refer to the Offshore Investment Platform brochure.

2. Invest via the Allan Gray Offshore Endowment

The recently launched Allan Gray Offshore Endowment, issued by the Guernsey branch of Allan Gray Life Limited, is an investment-linked long-term product that offers tax efficiency if your marginal tax rate is higher than 30%, as well as estate-planning benefits. This product has been designed to provide more flexibility than traditional endowment products and offers a range of funds similar to those on our offshore investment platform, while offering competitive pricing and familiar client service through our local team. The minimum investment amounts for our offshore endowment are higher than for our offshore platform.

The Allan Gray Offshore Endowment is competitively and transparently priced, with no VAT payable on administration fees.

Following, we outline the benefits of investing in an offshore endowment, touching on some frequently asked questions about our product, and in Table 1, we summarise the differences between the various options for investing offshore through Allan Gray.

What are the key benefits of investing in an endowment?

Tax efficiency

The income tax rate within an endowment is fixed at 30% for individuals. The effective tax rate for capital gains if you invest in an endowment is therefore 12% (capital gains inclusion rate of 40%, which is taxed at a fixed rate of 30%), compared to a maximum effective tax rate of 18% for a marginal taxpayer on gains in a basic unit trust investment (capital gains inclusion rate of 40%, which is taxed at 45%). The product therefore becomes tax-efficient when your marginal tax rate is higher than 30%. Different tax rates apply to companies and trusts.

We do the calculation, deduction, and payment of any tax due on your behalf, which simplifies your tax return. As you do not have to account for income or capital growth in your tax return, you will not be sent any tax certificates.

Estate-planning benefits

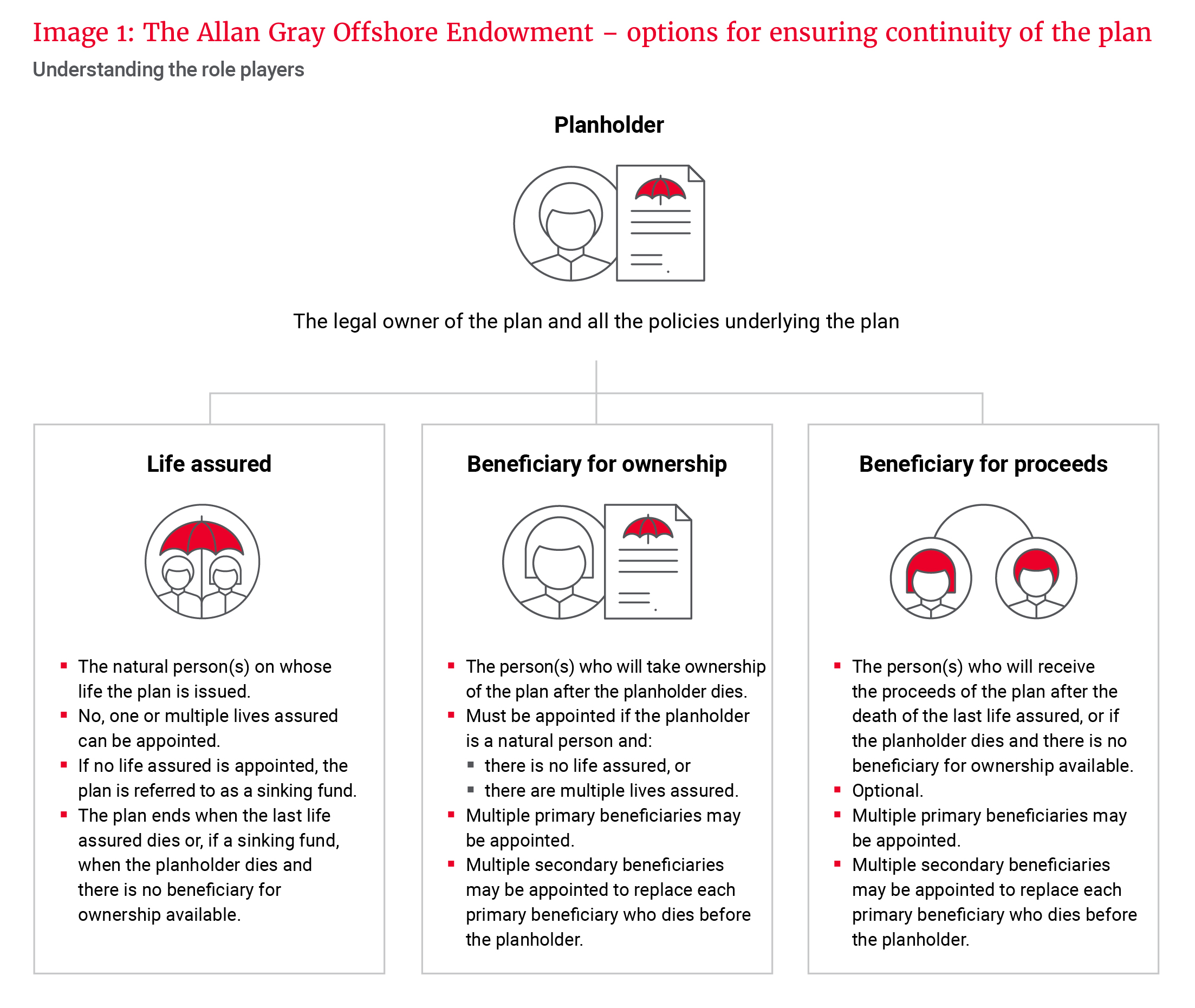

Estate-planning benefits allow for continuity and the transfer of wealth on your death. To understand how this works, you can familiarise yourself with the different role players you can use to structure your investment, described in Image 1 at the end of this article.

No offshore will is required, and although the offshore endowment will still form part of your estate for the calculation of estate duty (subject to any applicable exemptions), if you appoint beneficiaries, there will be no executor fees as transfer or payment of proceeds to a beneficiary does not have to be facilitated by an executor. This ensures quicker payment of the proceeds, or seamless continuity of the investment. Capital gains tax is only triggered when the investment is paid out, not if the investment continues.

Protection from creditors

The total value of your investment will be protected from creditors during your lifetime, provided the endowment is issued on your life or the life of your spouse and has been in force for at least three years. To qualify for creditor protection in the event of your death, your surviving spouse, children, stepchildren or parent must benefit from the endowment. This means that during your lifetime, the endowment cannot be attached or subject to execution under a court judgement, and when you die, the endowment benefits will not be available for debt payments.

Allan Gray Offshore Endowment: Frequently asked questions

Can I access my money?

The Allan Gray Offshore Endowment is structured as a single plan made up of multiple underlying policies, which allows for more liquidity than when investing in a single policy. This gives you some flexibility and the potential to make more than one withdrawal despite the restrictions imposed by legislation.

Is the Allan Gray Offshore Endowment expensive?

Some offshore endowments have drawn criticism for having opaque fee structures, usually consisting of multiple types of fees. The Allan Gray Offshore Endowment is competitively and transparently priced, with no VAT payable on administration fees. The annual administration fee percentage applicable to our offshore endowment is calculated monthly, using the average market value (in US dollars) for the month across all Allan Gray Local Investment Platform, Offshore Investment Platform and Offshore Endowment investments linked to your investor number.

Our endowment is structured such that multiple beneficiaries can be appointed, thereby allowing for continuity across generations …

What funds can I invest in?

Investment returns come from the underlying foreign currency funds that you choose. The Allan Gray Offshore Endowment offers a select list of foreign currency funds managed by offshore investment managers, including those managed by our offshore partner, Orbis. See our Offshore Endowment Fund List brochure or this page for more information about the funds that are available through Allan Gray Life Limited (Guernsey branch).

Do I need to deal with another service provider?

You will be able to engage through the usual channels. The Allan Gray Client Service Centre will be available to assist you, and most transactions can be done online. Your Allan Gray Offshore Endowment will reflect on Allan Gray Online alongside your other local and offshore platform investments. Although the Allan Gray Offshore Endowment is issued in US dollars, reporting is available in your preferred currency.

Are my investments safe?

We have appointed an independent Guernsey-based trustee to safeguard the plan assets by holding them in trust. The assets can only be used to meet obligations to investors, not to meet any other obligation of the company, for example to general creditors.

Will I invest in and have withdrawals paid out in foreign currency?

Contributions can be made in rands or foreign currency (US dollars, euros or pounds). We can facilitate rand currency conversions via our authorised dealer at a preferential spread if you use your single discretionary allowance, or have your own tax clearance to invest an amount over R1m offshore. Withdrawals can be paid out in rands, US dollars, euros or pounds.

Can my offshore endowment continue when I die?

Our endowment is structured such that multiple beneficiaries can be appointed, thereby allowing for continuity across generations, as shown in Image 1.

Consult an independent financial adviser if you need more guidance

At Allan Gray, we don’t offer financial advice. You may wish to consult an independent financial adviser, who can help you determine the appropriate level of offshore exposure to meet your long-term investment goals, and to help you select the offshore product and fund(s) that are appropriate for your needs and circumstances.

For more details about why you should invest offshore, see Horacia Naidoo-McCarthy’s article.

Over the years, the SARB has relaxed exchange controls, removing constraints on individuals taking money offshore, and making it considerably easier for individuals to transfer money abroad.

A South African citizen with a valid green barcoded ID or smart identification card has an allowance of R1m annually, which can be invested offshore without tax clearance from SARS. This is called the single discretionary allowance. You can use this allowance for any legal purpose offshore, including investing. This allowance includes all foreign expenditure, such as monetary gifts, loans, foreign travel expenses, maintenance and offshore credit.

If you have more than R1m to invest, and your affairs are in order with SARS, you can apply to SARS to invest an additional R10m offshore, over and above your single discretionary allowance. SARS will require documents demonstrating the source of capital to be invested, statements of assets and liabilities and bank statements if you want to avail of this allowance.