Annual contribution limits for tax-free investments and retirements funds have always been clear for individuals who have a full 12-month assessment period to work with. However, the rules for those with shorter periods of assessment were unclear. This was rectified when the legislation was amended earlier this year. Carrie Norden explains the changes in more detail.

Effective 1 March 2024, tax legislation was amended to aggregate the annual tax-free investment contribution limit (currently R36 000) and the maximum annual retirement fund contribution deduction (currently R350 000) over the 12 months constituting a tax year (i.e. 1 March to end-February of the following calendar year). Previously, the limits were allowed to be applied per assessment period. The changes ensure that taxpayers do not benefit from more than the intended annual amounts in a tax year, particularly for those who cease to be South African tax residents and have more than one assessment period during that time. In other words, taxpayers are not entitled to “double-up” on the annual tax-free investment contribution limit or the maximum annual allowable retirement fund contribution deduction if they have two assessment periods in a tax year.

Similar changes were made to tax legislation from 1 March 2023 to limit the annual interest exemption and capital gains tax exclusion when an individual ceases to be a South African tax resident during the tax year.

Who is impacted by these changes?

The changes impact those individuals who have shorter assessment periods (i.e. an assessment period of less than 12 months) for tax years starting from 1 March 2024 onwards.

Partial assessment periods may apply to individuals in the following scenarios:

- In the year in which a person is born (if they are liable for tax)

- In the year in which they die

- In the year in which they become sequestrated

- In the year in which their tax residence in South Africa ends (i.e. they become a non-South African tax resident during the tax year)

There are no partial periods of assessment in the year in which a person starts or stops earning income or becomes a tax resident in South Africa.

The impact of the changes will mainly be felt by those with more than one period of assessment in a tax year, particularly those taxpayers who cease to be South African tax residents during that time.

This is because those with only one shorter assessment period will still be entitled to claim the full annual limits in that shorter assessment period, whereas those with more than one partial assessment period will need to consider what they contributed or claimed during the first period when determining the remaining annual limits they qualify for in the second assessment period.

The changes will not impact you if you only have one full period of assessment in a tax year.

Understanding the impact of the changes

Since the impact of the changes will mainly be felt by those individuals with more than one shorter period of assessment in a tax year due to them ceasing to be a South African tax resident during that time, the below example focuses on this scenario.

When an individual ceases to be a South African tax resident during any tax year, tax legislation considers their year of assessment to end on the date immediately before the day on which they cease to be a tax resident. Their new year of assessment starts on the day on which they cease to be a tax resident. They will therefore have two shorter periods of assessment during the 12-month tax year.

Example

Mr W changed his tax residence from South Africa to the United Kingdom on 1 August 2024. He therefore has the following periods of assessment in the 2024/2025 tax year:

- First period of assessment: 1 March 2024 to 31 July 2024 (5 months)

Up until 31 July 2024, Mr W will be liable for tax on his worldwide income, as well as capital gains tax due on any assets that South African tax legislation deems to have been disposed of on the date before he ceased to be a South African tax resident (31 July 2024). - Second period of assessment: 1 August 2024 to 28 February 2025 (7 months)

Despite no longer being a South African tax resident, if he earns income from a South African source, Mr W may need to file a tax return with SARS for the period 1 August 2024 to 28 February 2025 for this income.

The maximum annual tax-free investment contribution limit and allowable annual retirement fund contribution deduction that Mr W is entitled to over the 12-month period (tax year) from 1 March 2024 to 28 February 2025 is R36 000 and R350 000 respectively.

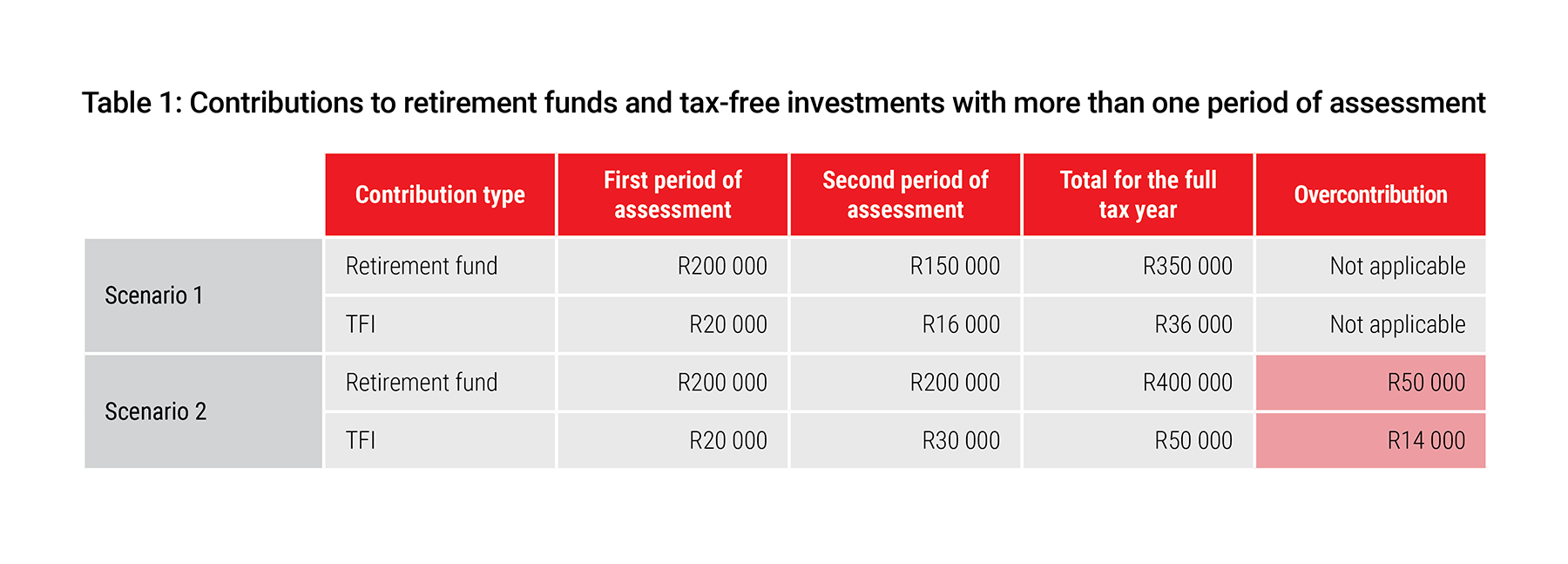

We can consider his contributions per assessment period and for the full tax year, as outlined in the scenarios below and illustrated in Table 1.

Scenario 1

- First period of assessment: Assume that Mr W contributed R200 000 to his retirement fund and R20 000 to his tax-free investment during this period. He will be allowed to deduct the full R200 000 retirement fund contribution for the assessment period and will not incur penalties relating to his R20 000 tax-free investment contribution, as both amounts fall below the annual limits.

- Second period of assessment: Mr W will only be able to claim an additional R150 000 retirement fund contribution deduction in this assessment period, as he already claimed R200 000 of the maximum R350 000 allowed for the full 12-month tax year.

Additionally, he will only be allowed to contribute an additional R16 000 to a tax-free investment (R36 000 less the R20 000 already contributed during his first period of assessment) before he will be liable for the 40% overcontribution penalty. (See Scenario 1 in Table 1.)

Scenario 2

In this scenario, we assume that during his second period of assessment in the 2024/2025 tax year, when he was no longer a South African tax resident, Mr W instead contributed:

- R200 000 to his retirement fund investment (in addition to the R200 000 he contributed during his first period of assessment)

- R30 000 to his tax-free investment (in addition to the R20 000 he contributed during his first period of assessment)

Mr W will only be able to claim R150 000 (i.e. the R350 000 maximum allowable retirement fund contribution deduction for the tax year less the R200 000 he contributed during the first period of assessment) during the second period of assessment.

The additional R50 000 (i.e. the R200 000 he contributed during the second period of assessment less the R150 000 maximum annual balance remaining) will carry over to the 2025/2026 tax year and be available for Mr W to use then, along with any additional retirement fund contributions he makes, subject to the annual limit of R350 000. Any excess will continue to roll over to future tax years until used.

As Mr W is only entitled to contribute R36 000 to his tax-free investment over the full 2024/2025 tax year, he will be liable to SARS for a penalty which will be calculated as follows:

Total amount contributed to a tax-free investment over the 2024/2025 tax year less the maximum allowable contribution, multiplied by 40%

= (R50 000 – R36 000) x 40%

= R14 000 x 40%

= R5 600

This penalty will be imposed by and payable to SARS in the second assessment period when he exceeded the annual limits (i.e. the assessment period ending 28 February 2025).

Consult your financial adviser or tax practitioner for further assistance

If you need help interpreting the legislation and understanding how it may apply to you, speak to your financial adviser or tax practitioner, or contact SARS directly on 0800 00 7277.